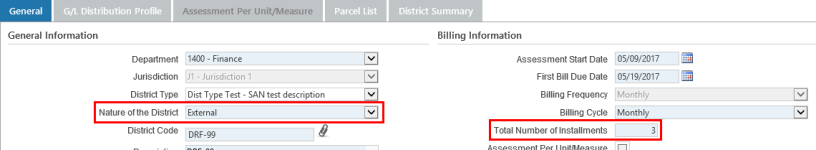

The Nature of District “External” Option

The Nature of District “External” option allows users to manually define the exact billing amount for all payment installments, opposed to letting the system calculate the installment amounts automatically as it does for other Nature of District types.

When External is selected as the Nature of District, all of the fields in the Interest Information and Payment Information sections are disabled, as are the following check boxes and fields in the Billing Information section: Assessment Per Unit/Measure, Default Assessment Amount per Parcel, Grace Period, Grace Period End Date, Partial Payment During Grace Period, Accrue Interest During Grace Period, and Interest Start Date.

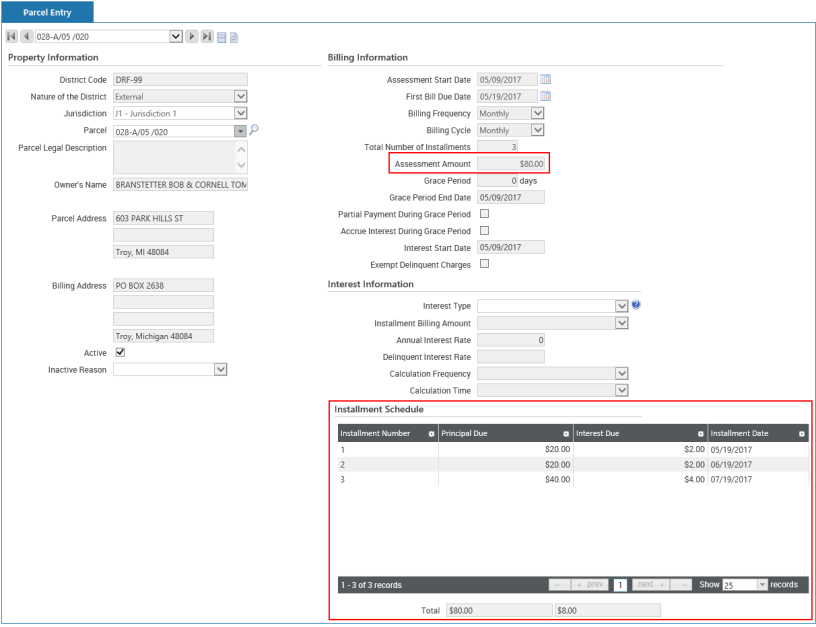

When an external district is successfully saved, an Installment Schedule is created and added to the Parcel Entry tab (see below).

The installment schedule will contain one row for every installment payment. The number of installment payments, and thus the number of rows in the schedule, are determined by the value entered in the Total Number of Installments field in the General tab. For example, if a user entered "3" in the Total Number of Installments field in the Prep Roll District Entry page's General tab, then three rows will appear in the Installment Schedule grid in the Parcel Entry tab.

The user can then manually enter the Principal Due and Interest Due for each payment installment in the Installment Schedule. This is done by clicking in the Principal Due table cell for a given Installment Number and entering the appropriate amount, doing the same in the Interest Due cell, and then repeating these steps for each remaining installment payment.

The Total fields below the grid display the Principal Due total and Interest Due total respectively.

The first installment will have an Installment Date equal to the First Bill Due Date (as defined in the General tab). Every installment after the first installment will be dated based on the user-defined Billing Frequency.

The Assessment Amount field displays in the Parcel Entry tab for external districts only. When a new parcel is added, this field’s default value is $0.00. As the installment schedule is defined, however, the Assessment Amount updates to always equal the sum total of the Principal Due as defined in the Installment Schedule. If no data has been entered in the installment schedule section, then this field will remain $0.00.

After the user has entered all the necessary information in Parcel Entry, clicking Save will initiate a check for errors. If errors are detected, informative error messages will display. If no errors are detected, the installment schedule will be saved.

Note: The Per Unit/Measure Rates section does not display in the Parcel Entry tab for External districts.

Note: When an external district is validated, an error will display if any parcel in the district has an Assessment Amount that is less than or equal to $0.00.

Note: When an external district is posted, the G/L entries are made to the relevant deferred revenue and receivable accounts.

Calculations for External Districts

The following amounts, which are provided on the Special Assessments Account Inquiry page (and elsewhere), are calculated based on the user-defined As of Date:

-

Unbilled Principal Balance = Total Principal Amount (per Installment Schedule) – Billed Principal Amount – Any payment made to Unbilled Principal.

-

Unbilled Interest = Total Interest Amount ( per Installment Schedule) – Billed Interest Amount – Any payment made to Unbilled interest

-

Billed Principal Balance = Total Billed Principal Amount – Paid Principal Amount

-

Billed Interest Balance = Total Billed Interest Amount – Paid Interest Amount

-

Delinquent Interest = $0.00

-

Payoff Balance = Unbilled Principal Balance + Unbilled Interest Balance + Account Fees + Billed Principal Balance + Billed Interest Balance + Billed Penalty Balance

Making Changes After an External District’s Installment Schedule Has Been Created

-

If the following fields are changed after the installment schedule has been created, the installment schedule will be deleted and will have to be recreated based on the new value(s): Assessment Start Date, First Bill Due Date, Billing Frequency, and/or Total Number of Installments.

When a change to any one of these fields is attempted, however, a message will appear informing the user that should they proceed with the change the installment schedule will be deleted. At this point, the user has the option of canceling the change by clicking Cancel or the

button in the message window.

button in the message window. - To change the installment dates, the user must change the First Bill Due Date in the General tab. When this value is updated, a message will display informing the user that changing the First Bill Due Date will delete all the values previously entered in the installment schedule, which must then be recreated.

- If the Assessment Start Date for an external district is changed after the installment schedule is created, the schedule will be deleted and the user will have to recreate it.